When it comes to shopping TJ Maxx is one of the American’s favorite. With small prices for some pretty cool outfits, it’s a must-see if you are looking to spruce up your appearance (and household) without making a huge dent in your wallet.

Just like any other big store, TJ Maxx have their own rewards credit card offering. Today we’ll prepare you the COMPLETE guide to use the TJmaxx Credit Card, make the payments and find how the customer support can be contacted.

TJmaxx Credit Cards

There are 2 options actually, each with its own perks:

TJX Rewards® Credit Card

TJX Rewards® Platinum MasterCard

Both credit cards have a hefty APR (29.24%), no foreign transaction fees for the MasterCard option and 3% for the regular TJmaxx Credit Card.

When applying, based on your credit score and other criteria, you will be assigned one option. No annual fees on any of these credit cards either.

If you are a frequent shopper at T.J.Maxx, Marshalls, HomeGoods, Sierra Trading Post, then you’ll come to love these credit cards, although other rewards credit cards offer even better perks.

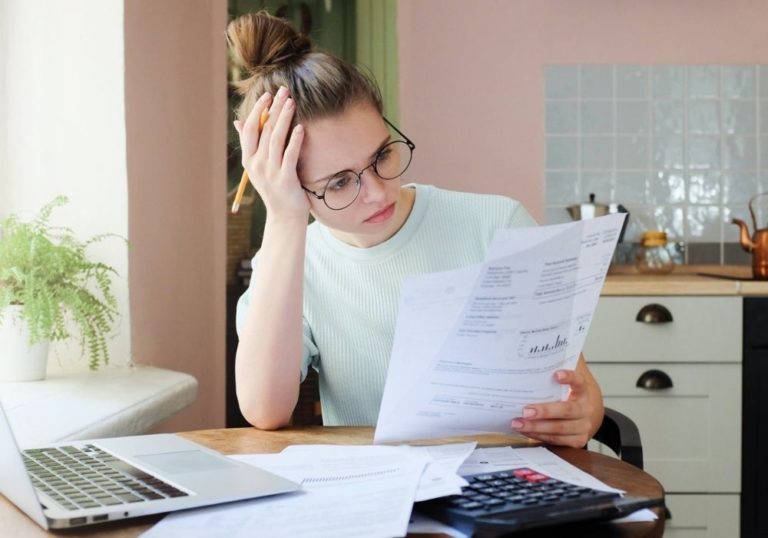

How to Use Your TJmaxx Credit Card Responsibly

I am a firm believer that credit cards can get you a lot of advantages, but can also get you into some serious debt. This is why responsible use is mandatory, in order to get the rewards and not get into debt.

Must read:

What Is a Credit Card Balance

How Do Credit Cards Work

Now that you read these 2 articles, let’s see how we can use our credit card responsibly:

- don’t buy just because of the rewards. I know a lot of rebate companies (Rakuten and the likes) are trying to make you spend more for the cashback, but the more you spend the more you don’t save. 2-3% is nothing, if you get into financial trouble. Instead of ‘earning’ 20 bucks for shopping, how about if you didn’t spend 1K for junk that you really don’t need?

- pay your credit card balances in full every month. Yes, you can make minimum payments and can carry a balance until you retire. Why would you do this? The TJmaxx Credit Cards have an APR close to 30%, this means that, if you buy merchandise worth of $1,000, you will pay in interest an additional 300 bucks this year. I don’t know about you, but I can find a better use for 300 bucks.

- beware of foreign transactions. Unless you have the TJX Rewards® Platinum MasterCard, with 0% foreign transaction fees, you are looking at 3% fees on the other card version.

- don’t get cash advances – a credit card is not your emergency fund. Don’t use it to get money at the ATMs, as it will hurt your budget dearly.

TJmaxx Credit Card Payment

From all payment options, I find paying online to be the easiest one of all. It’s fast and more accurate than any other options.

There are no options to pay your credit card at the nearest store, you can pay by mail or by phone (you will be charged a nominal fee).

- Pay by phone – call on the number you see on the credit card and you will be directed to a live representative. Before allowing the payment transaction ask about a fee and, if you agree with it or there is no payment fee, make the payment.

- Pay by mail – send your payment to GE Money Services, P.O. Box 965016, Orlando, FL 32896

Read more:

TJmaxx Credit Card Payment Methods

TJmaxx Credit Card Payment Online

In order to pay your credit card, view your balances and manage your account, please log in at: https://tjx.syf.com/. Always make sure your contact information is accurate, check your current balance and try to pay in full by the end of your billing period. I personally log into my credit card account at least on a weekly basis, even with automatic payments set.

I like to see how I fared the past few days, how much money I have to pay and, if my checking account allows it, I do make partial payments at least to stay on track.

Questions about your TJmaxx Credit Card? Call the number below.

TJX Rewards® Credit Card: 1-800-952-6133

TJX Rewards® Platinum MasterCard®: 1-877-890-3150

Do you use the TJmaxx Credit Card? Are you pleased with it? Would you recommend another store credit card?

![TJmaxx Credit Card [The Complete Guide]](https://creditcardpaymentsnow.com/wp-content/uploads/2019/12/TJmaxx-Credit-Card-The-Complete-Guide.jpg)