When it comes to investing, most of us have an issue: lack of knowledge and the fear that we’ll lose the money. Not to mention that many financial advisers tell us we should prepare a decent budget, not invest with 10 bucks.

I personally have stayed from investing all this time, because I am personally afraid to squander my money. As my time is limited, I cannot spend weeks to get a better investing education and then start spending thousands of our hard-worked money.

Small Business Bonds Investing with SMBX

Small Business Bonds are different from stocks: with bonds, you are are lending the business money, as opposed to buying a share from the business, yet with a decent interest rate, they make a great investing opportunity.

What’s even better, with the SMBX small business bonds investing system is that you don’t have to invest a lot of money.

As most of our readers are probably already focused on paying off debt, saving aggressively and preparing for what life has to offer (let’s not forget we’re going through a pandemic, right?), having to invest thousands of dollars might not be right up your alley.

It’s certainly not up mine.

This is why being able to invest as little as 10 bucks in the company you like, is an exceptional start. Of course, if you can invest hundreds or thousands (my account is capped at $5K), by all means do so.

How to Start Investing with TheSMBX.com

- Go to: https://thesmbx.com/

- Click on the big yellow button in the top right: START INVESTING.

- Create your free account and make sure to add your details CORRECTLY. This is an investing website, double-check your data.

- Look at the BONDS offering and choose what you like better.

- You can pay with a credit card (you will pay a processing fee) or connect your bank account.

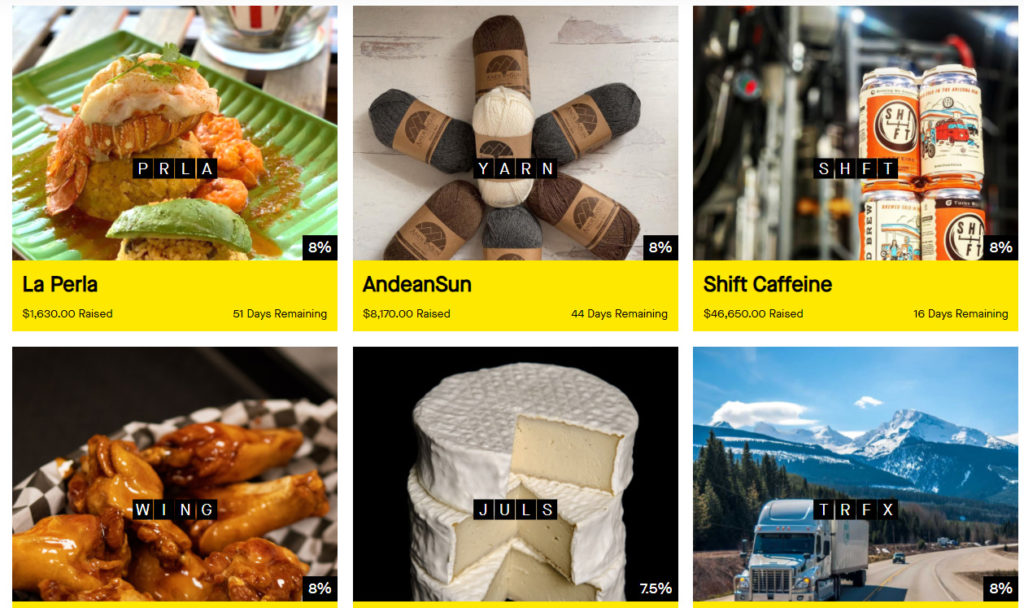

This is a sample view of the current bonds I can invest in. You can choose whatever type of business you’d like to invest in, from trucking to coffee brewers or kid related businesses. The interest is good on any of them, the smallest I noticed so far is 7% and the biggest 10%.

Another thing I like is the easy to use investing portal, you can see your account details (and amend them), current portfolio and what new bonds to invest in. Another useful feature: you get notified as soon as a new bond is being offered, so that you can invest as soon as possible.

For the campaigns that are finished, I have seen big investments ($25K, $10K) and also smaller ones ($1K, $250 or $50). The lowest accepted investment is $10, there are few people who committed this sum. Of course, returns are different for someone who invested $10K and someone who invested 1000 times less.

Is It Safe to Invest in Small Business Bonds?

As with any investments, you should only invest the money you are willing to lose, in case something goes wrong. The fact you can invest even smaller amounts, while you familiarize with the system and build your bonds portfolio is a great advantage. In time you’ll increase your investment capital and earn even more money.

In order to fully understand how the small business bonds work, carefully read the FAQ.

Happy investing 🙂