As you probably know we’re fresh immigrants and had no credit history at all in the US.

We are debt free and plan to remain like this for as much as possible, but we soon found out that even getting rent or securing an insurance plan require some form of credit history. And we had none.

We had to find out how to improve credit score and do it fast, as it would be a pain for our financial future.

As we already had checking accounts with Chase, our friends advised our to ask for a credit card. Some even told us to get a Macy’s or Amazon credit card, as they’re supposedly given out like candy, so that we can start improving our credit score.

Husband didn’t have a job those first weeks and my small healthcare marketing agency got me almost no considerable income. So, no credit cards from Chase or the retailers.

After few weeks my husband did get a job and lo and behold, not a month passed when Chase contacted him to offer a credit card. Hmm, how sweet!

Since he didn’t want to complicate his life anymore and search for other credit cards, he just accepted the offer and tied the new credit card to his existing account.

I was, of course, still ineligible, as I didn’t have a steady income nor a longer history of client payments.

Improve credit score with a secured credit card

Since I do have enough financial literacy and friends to guide me through these stormy financial seas, I decided to look into a secured credit card.

Here is how a secured credit card works:

- create an account

- send some money

- based on your deposit you’ll receive a credit limit

- pay in full and improve credit score

- eventually get your money back and get a more decent credit card deal

Armed with this information, I applied for a credit card with CapitalOne. It took about 2 weeks to actually get approved, send in the deposit and get my credit card, but it finally arrived and I was set.

I started using my Capital One secured credit card from day one, even if still apprehensive, as I never had a credit card in my life. I could have tried to get a Chase secured credit card, but I was a little pissed on them not allowing me to get a credit card in the first place, so I decided to take my business elsewhere.

Even now I actually consider keeping my Capital One account and not accept a Chase offer too soon. Well, we’ll see.

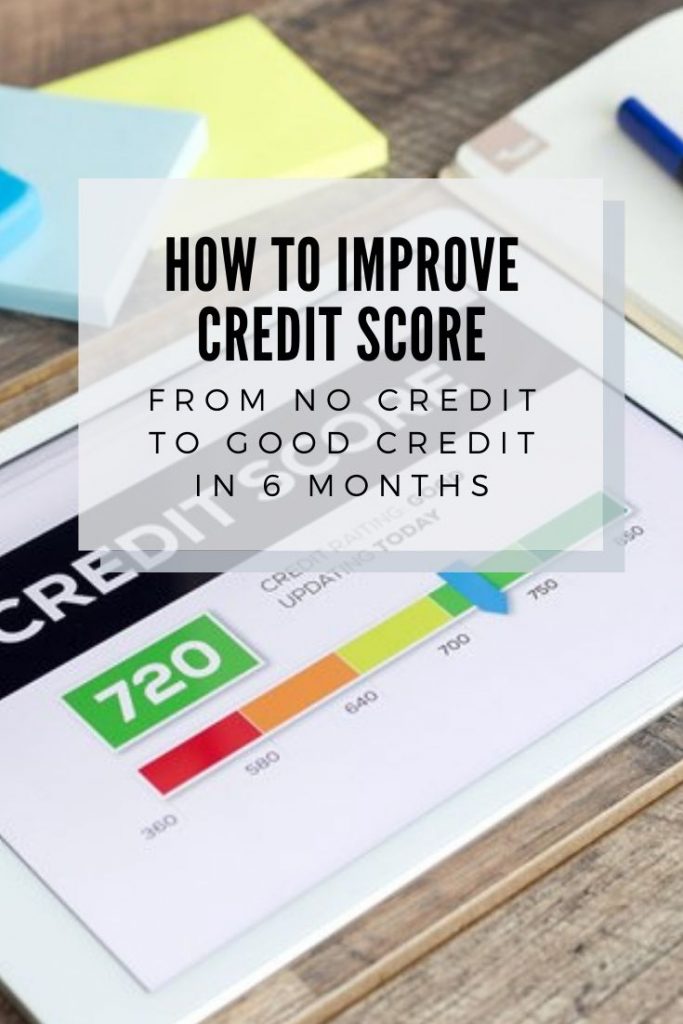

How I improved my credit score 62 points in 6 months

- I started from no credit score to 665. This is was the first month’s credit score.

- I deposited 500 dollars (I could have deposited less, but the more you can add the better). The bank was ‘nice’ enough to give me a 517 credit limit (500 mine and 17 from the goodness of their hearts :)).

- I paid IN FULL every month. As mentioned, we’re scared of getting into any debt (since we can’t actually afford it anyway), so we’re paying in full every month. We’re as crazy as to make 3-4 payments during the month, so that we’re sure it’s all paid up (yes, we have automatic payments, but we are weird this way).

- My current credit line is $951, it slowly increased in the first months and not it’s close to double my initial deposit.

- My credit score is now 727, which is a clear improvement on the 665 I started with. I expect it to increase even further the following months, as my monthly expenses are way lower than my credit limit and I have no intentions of not paying the balances in full anyway.

Which of the Following Actions Would Improve Your Credit Score?

I am speaking from personal experience here, as I did make one big mistake that actually cost me few credit score points (or at least it didn’t increase as fast as it could have).

On-Time Payments

VERY IMPORTANT. Husband actually tried to leave 18 bucks on his balance, as some friends told us it would increase his credit score faster and it actually did the opposite. Fortunately it wasn’t a huge deal, as 18 bucks are not a lot even for poor immigrants like us, but still, we decided to not leave even one cent unpaid.

So we’re paying our balances in full and even more times a month, since we’re terrified of being penalized 38 bucks in late fees.

Credit Line Age

Well, we have little over 6 months of credit card use, so in our case this hinders us in increasing our credit score too fast. After 1-2 years our oldest credit line will get more … tenure, so we’ll probably rank better in this area as well.

Credit Used

Told you about a mistake .. while I cannot control my credit line age and will pay in full every month, I did use the credit card a little too much 1-2 months. As I didn’t look too closely at this, all the groceries were bought on it. Getting a bigger percentage of available credit used cut about 10 points off my credit score.

Now that my credit limit is close to a thousand bucks and we’re still very frugal, there’s almost no chance of me going overboard anymore. Not to mention that I know this would decrease my credit score.

Recent Inquiries

As we don’t apply for any other loans or credit cards, we had no additional inquiries. For this I ranked perfectly.

New Accounts

Since we don’t plan on getting into any debt and our budget is very strict, getting new credit card accounts is out of question. I am debating whether to switch to Chace after getting my initial deposit back or stay with Capital One, but it remains to be seen.

We might look into some reward credit cards, maybe a Best Buy Credit Card, but, again, we’re not rushing anywhere.

Available Credit

While still very small, compared to what most of you actually have, my $951 is enough for now and will probably increase more. I already got new offers from Capital One ($1,200 credit limit, even $2,000 few weeks ago), but so far the deal I have is more than enough to improve credit score.